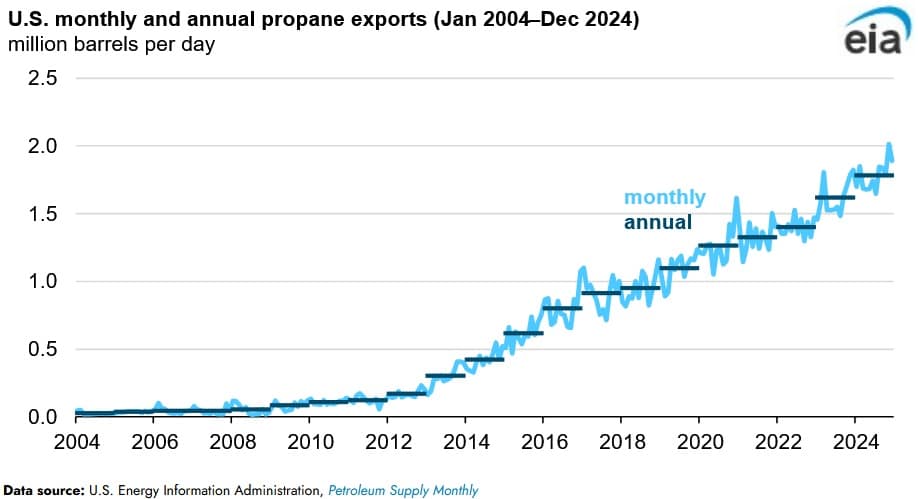

U.S. Propane Exports Increase for Each of The Last 17 Years: EIA

U.S. propane exports averaged 1.8 million barrels per day (b/d), a record high during 2024, according to an March 13 report published by the U.S. Energy Information Administration. The U.S. is a net exporter of propane and as a result, exports can impact wholesale propane prices, since higher exports reduce domestic supply and generally lead to higher wholesale prices. Moreover, U.S. propane exports have risen every year for the last 17 years, in line with robust demand in East Asia, particularly from China and a wider propane price spread between global and U.S. propane benchmark prices.

U.S. propane production has reached record high volumes and been a vital driver behind the increase in propane exports. U.S. propane production has risen significantly over the last decade, in line with increasing U.S. natural gas production. Furthermore, higher propane production and as a result additional supply has had a bearish impact on U.S. propane prices in comparison to Asia, and therefore supporting the record export volume.

Developments in infrastructure have been critical in accommodating increasing shipments. Expansion infrastructure projects at U.S. propane export stations have permitted U.S. exports to rise by over 700,000 b/d. U.S. propane exports exceeded 2 million b/d during November 2024 occurring for the first time, in line with petrochemical and heating demand in Asia.

U.S. propane exports on an annual basis to Asia increased 13 percent year-on-year during 2024, up by 131,000b/d, with the majority of the volume going towards China, South Korea and Japan. Chinese usage accounts for the majority of the increase in U.S. exports to Asia, propane exports to China rose by 40 percent during 2024. Rising propane exports to the Asian market are due to the region’s rising propylene demand.

U.S. producers have also exported significant propane volumes in Asia, as a result of voluntary crude oil production cuts made by OPEC+ members reducing propane production from these countries over the last two years. Moreover, higher propane demand as a petrochemical feedstock in Asia has led to elevated propane prices in East Asia relative to U.S. Gulf Coast spot prices, financially incentivizing exports from the U.S. to the region.

U.S. propane exports to Europe remained flat during 2024 compared to 2023, having increased significantly during 2022, in response to Russia’s assault on Ukraine.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL