U.S. Propane Prices Higher So Far This Winter Heating Season Compared to Last Winter: EIA

U.S. wholesale and retail propane prices have traded higher so far this winter heating season compared to the previous year, according to an Jan. 28 report published by the U.S. Energy Information Administration. The higher prices witnessed so far this winter can be attributed to colder weather during January and higher exports.

The price increase across propane markets has been evident, despite high propane inventories. U.S. propane stocks were recorded at 100 million barrels at the end of the week of Nov. 1,2024, around 11 percent higher than the previous five-year average. Propane stocks remained above the previous five-year average for the majority of the storage injection period during 2024, which usually runs from April through until October.

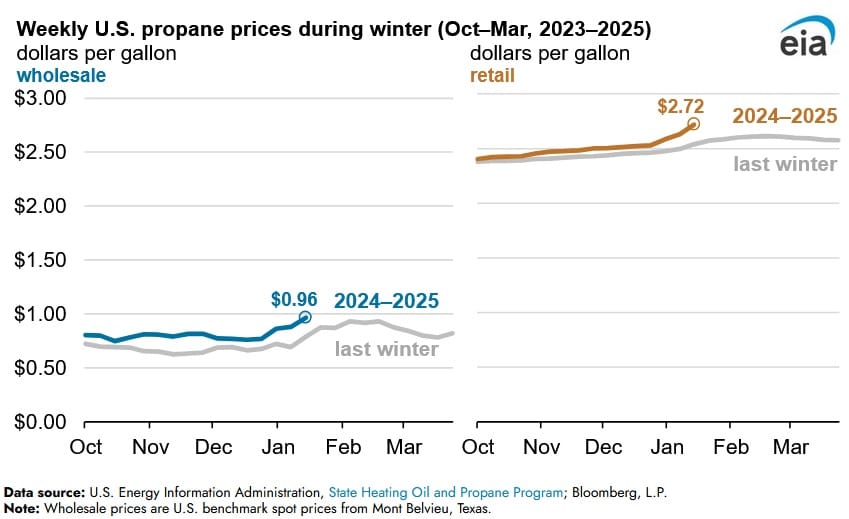

U.S. wholesale propane spot prices on the U.S. benchmark at Mont Belvieu, Texas, have averaged $0.81 per gallon (gal) during the winter heating season so far (October 2024 – January 2025), up $0.13/gal compared to the same months in the previous winter. The U.S. is a net exporter of propane and as a result exports can impact wholesale propane prices, since higher exports reduce domestic supply and generally lead to higher wholesale prices. The U.S. exported record volumes of propane during 2024, averaging 1.8 million barrels per day, up nine percent compared to 2023.

U.S. retail propane prices generally follow wholesale propane prices and are impacted by supply and demand fundamentals. Historically, propane prices increase during the winter heating season, when demand for propane is high and propane inventories decline. U.S. retail propane prices have averaged $2.51/ gal so far this winter, up $0.07/ gal compared to the same period in the previous winter.

Retail propane prices for the East Coast (PADD 1), Midwest (PADD 2), Gulf Coast (PADD 3), and Rocky Mountain (PADD 4) are higher this winter compared with this time last winter. Retail prices in all four regions traded relatively flat until mid-January, when wholesale Mont Belvieu prices began to increase as temperatures dropped. In both January 2024 and 2025, winter demand peaked as measured by heating degree days, which specify how cold the temperature was on any given day.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL