U.S. Refineries Increasingly Reliant on Canadian Crude Oil: EIA

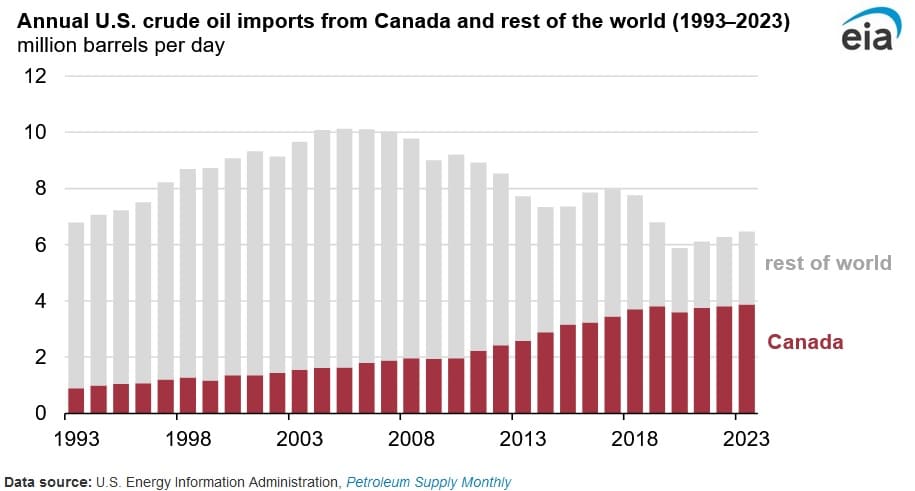

U.S. crude oil imports from Canada are significantly imperative to U.S. oil refiners, accounting for the majority of total U.S. crude oil imports, according to an August 1 report published by the U.S. Energy Information Administration. As of Jan. 1, 2024 U.S. oil refining capacity was recorded at 18.4 million barrels per day (b/d). During 2023, 60 percent of total U.S. crude oil imports were from Canada, significantly higher than in 2013, when 33 percent of U.S. crude oil imports came from Canada.

The increase in U.S. crude oil imports from Canada can be attributed to higher crude oil production in Canada and geographic proximity. Imports from Canada to the U.S. rose on average by four percent yearly, from 2013 to 2023. Canadian crude oil exports to the U.S. totaled 24 percent of U.S. refinery throughput during 2023, up from 17 percent during 2023.

During 2023, Canadian crude oil production averaged 4.6 million b/d, around three times the nation’s refinery capacity. A large number of U.S. refineries are intended to manage heavy oils like those formed in Canada’s oil sands, producing refined products such as plastics, chemical, diesel and gasoline.

Geographic closeness permits Canadian pipelines to transport crude oil from the western provinces, mostly from Alberta’s huge crude oil production region to refineries in the U.S. Moreover, inland regions of the U.S., particularly the Rocky Mountains and Midwest are closely linked to Canada’s oil markets via rail networks and pipelines. Furthermore, takeaway capacity exists for shipments to the Gulf Coast.

Pipeline capacity transporting Canadian crude oil exports has risen over the last few years. The Express Pipelines capacity increased during 2020 from 287,000 b/d to 310,000 b/d. This allowed producers to increase oil sand exports from Western Canada to the U.S. Rockies region refineries. The Trans Mountain Expansion Project became operational during May 2024 and significantly increased pipeline capacity to Canada’s Pacific Coast to 890,000 b/d.

Western Canadian Select crude oil (WCS) per barrel is usually priced less than the U.S. benchmark West Texas Intermediate (WTI) per barrel due to WCS being a heavier blend and necessitating additional processing and advanced refinery units with higher operational expenditures.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL