U.S. Shale Gas Production Could See First Annual Decline in Over Two Decades: EIA

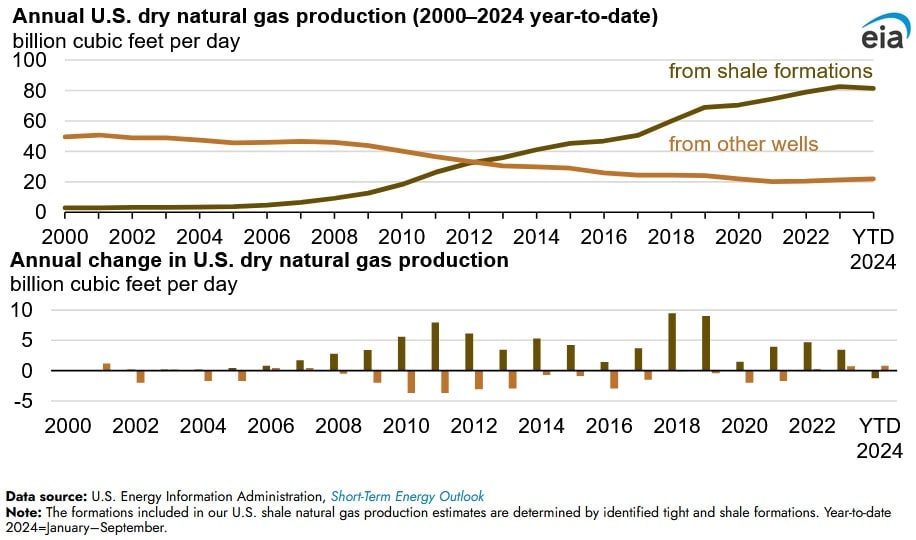

U.S. natural gas production from shale and tight formation marginally declined between January to September 2024, compared to the same period in 2023, according to an Oct. 23 report published by the U.S. Energy Information Administration. If the same trend prevails for the remaining months during 2024, this would be the first year-on-year decline in U.S. shale gas production since the agency began collating data in 2000.

Total U.S. shale gas production during the first nine months of 2024 declined by around one percent to 81.2 billion cubic feet per day (Bcf/d) compared to the same months in 2023. U.S. natural gas production from shale and tight formations accounts for around 79 percent of dry natural gas production. Despite U.S. shale production declining during the first nine months of 2024, U.S. dry natural gas production rose by around six percent to 22.1 Bcf/d. Dry natural gas production rose 4 percent to 39 British thermal units during 2023, a record high. The regions of Appalachia, Permian, and Haynesville accounted for 59 percent of total U.S. natural gas production. U.S. natural gas production has increased over the last two decades due to developments in drilling techniques and the utilization of shale gas reserves.

The reduction in shale gas production during 2024 can be attributed to lower production in the Utica and Haynesville plays. During the first nine months of 2024, shale gas production declined by 10 percent or 0.6 Bcf/d in Utica and 12 percent or 1.8 Bcf/d in Haynesville compared to the same period during 2023. Meanwhile, shale gas production in the Permian play increased by 10 percent or 1.6 Bcf/d, while production in the Marcellus play remained flat.

Natural gas prices are a key driver of drilling and developing wells in the three plays: Haynesville, Utica and Marcellus. U.S. natural gas prices on the Henry Hub benchmark have generally declined since August 2022, and hit record lows during the first six months of 2024. As a result of lower natural gas prices, drilling natural gas wells has become a less profitable activity. A number of operators in the Appalachian Basin and Haynesville shut down natural gas production, due to low prices.

On the other hand, in the Permian play natural gas production is mainly associated gas from oil wells, and as a result drilling activities are determined by the oil price. Natural gas production in this region rose during 2024, due to rising oil production.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL