U.S. Thermal Coal Exports to Europe Decline by 63 Percent: EIA

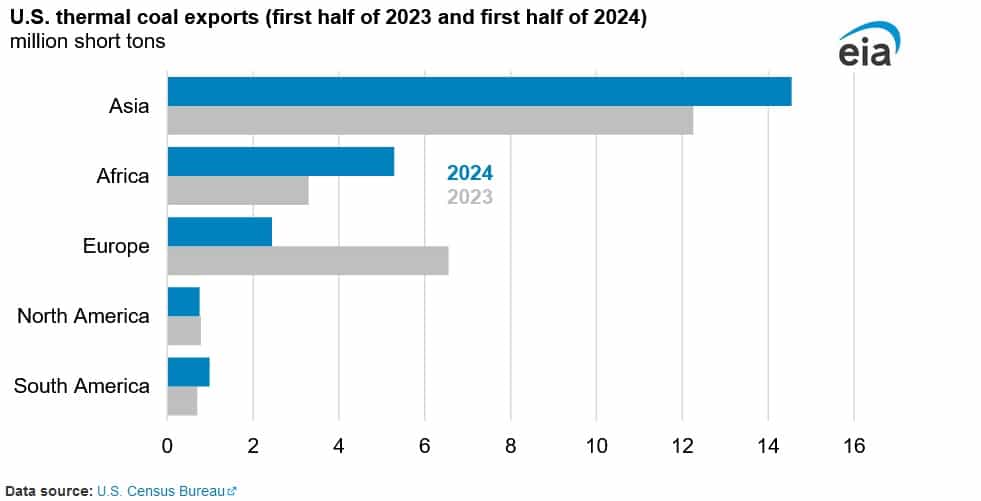

U.S. thermal coal exports to Asia and Africa increased during the first six months of 2024, according to an Sept. 4 report published by the U.S. Energy Information Administration. Overall U.S. coal exports for both metallurgical and thermal coal rose by 4 million short tons (MMst) to 53 MMst during the first half of 2024, compared to the same period during 2023.

U.S. thermal coal exports to Asia rose by 19 percent to 2.3 MMst during the first half of 2024, compared to a similar period in 2023. The increase in Asia was largely driven by higher exports to India and China. The Indian share of U.S. exports accounted for 57 percent of the exports to Asia during 2023 and the country continued to import a large quantity of U.S. thermal coal during the first six months of 2024. High Indian coal imports from the U.S. is due to robust demand from industrial customers in the brickmaking sector. Asia overtook Europe in 2017 and became the largest importer of U.S. thermal coal.

Exports to Africa rose by 60 percent to 5.3 MMst during the first six months of 2024, compared to the same period in 2023. During the first half of 2024, 98 percent of all U.S. thermal coal exports went to Morocco and Egypt. U.S. coal exporters shipped 2.4 MMSt to Egypt and 2.8 MMst to Morocco during the first half of 2024, compared to 1.8 MMst and 1.4 MMst during the first half of 2023. The increase in U.S. thermal coal exports to North Africa, can be attributed to robust industry demand, mainly from brickmakers and cement plants. Importers from North Africa value the high heat content of U.S. thermal coal, since it makes their operations more efficient.

Following the Russian invasion of Ukraine and the subsequent sanctions on the purchasing of energy from Russia, U.S. thermal coal exports increased to Europe. U.S. thermal coal exports to Europe rose from 6.4 MMst during 2021 to 14 MMst in 2022, but dropped during 2023 to 10.5 MMst. Exports to Europe further declined during the first half of this year totaling 2.4 MMst, down 63 percent compared to the first half of last year. The decrease in U.S. thermal coal exports to Europe can be attributed to weak demand as a result of a warm winter, higher gas usage for electricity generation and robust renewable generation.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL