U.S. Wholesale Natural Gas Prices to Rise in 2025-2026 Amid Higher Demand: EIA

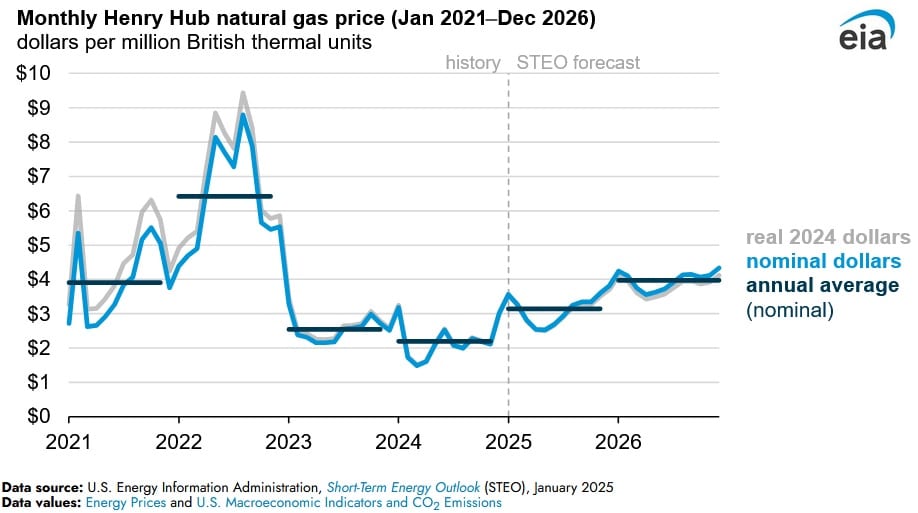

The Henry Hub natural gas price during 2025 and 2026 is expected to increase, according to an Jan. 23 report published by the U.S. Energy Information Administration. The projected price increase can be attributed to natural gas demand outpacing supply, due to higher gas demand from U.S. liquefied natural gas (LNG) facilities. This in turn, will reduce gas stocks in storage facilities compared to the last two years and provide prices with underlying support. The agency projects the U.S. benchmark Henry Hub average natural gas price to increase during 2025 to $3.10 per million British thermal units (MMBtu) and average $4.00/MMBtu during 2026, following record low prices in 2024.

The agency projects total U.S. demand for natural gas to increase by 3.2 billion cubic feet per day (Bcf/d) during 2025 and by a further 2.6 Bcf/d in 2026, driven by more demand for natural gas for LNG exports. The agency expects LNG exports to increase by 2.1 Bcf/d during 2025 and by a further 2.1 Bcf/d during 2026.

The U.S. LNG industry is experiencing a notable growth phase, set to increase its base load capacity by 73.6 million metric tons per annum (MTPA) by 2028. This expansion is characterized by the advancement of multiple major projects, intended to bolster the nation’s standing as a prominent LNG exporter. Moreover, LNG exports have become more profitable for North American producers since the Russian invasion of Ukraine. Higher gas prices in the UK, European and Asian markets have made profitability margins attractive for North American sellers, amid a structural shift in trading dynamics, following the cessation of Russian pipelined gas to Europe. Increasing profitability of LNG exports for producers has been the underlying driver behind the construction and financing of new projects.

During 2025, the agency expects increases in demand, which includes domestic natural gas consumption and exports to surpass increases in supply, which includes domestic natural gas production and imports. During 2026, the agency expects demand to continue growing faster than supply. Dry natural gas production is the key driver of supply growth in the agency’s forecast, increasing by 1 percent to 104.5 Bcf/d in 2025 and by around 3 percent to 107.2 Bcf/d in 2026.

Moreover, the agency projects natural gas inventories to be below the rolling five-year average in the third quarter of 2025 and remain below the rolling five-year average for the remainder of the forecast period.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL