U.S. LNG Exports Expected to Decline by Six Percent for Rest of 2022 Amid Freeport Outages: EIA

The U.S. Energy Information Administration slashed its spot natural gas price forecasts for the second half of 2022 according to a July 12 report primarily due to lower-than-expected liquefied natural gas exports stemming from the extended outage at the Freeport LNG facility. The agency expects 10.5 billion cubic feet per day in U.S. LNG exports for the second half of 2022, down six percent from the first half of the year, after adjusting for the outage at the Freeport facility, which accounts for 17 percent of U.S. LNG export capacity. The new forecast is a 14 percent decrease compared to the agency’s June forecast.

U.S. LNG exports averaged 11.2 billion cubic feet per day during the first half of 2022, setting a monthly record in March of 11.7 billion cubic feet per day. Strong gas demand and higher LNG prices in Europe and Asia drove the continued growth of US exports. During the first five months of 2022, the U.S. exported 71 percent of its LNG to Europe, compared with an annual average of 34 percent last year. Asia was the leading destination for U.S. exports in the past, accounting for almost half of total exports in 2020 and 2021. U.S. export capacity will continue to expand this year with the addition of the Calcasieu Pass LNG terminal, which has been ramping up ahead of schedule to begin operations in late 2023.

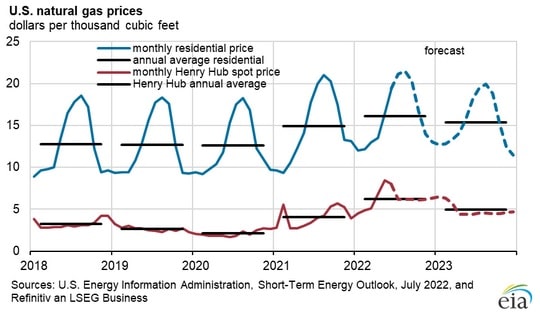

Henry Hub spot prices averaged $6.07 per metric million british thermal unit in the first half of 2022 rising from $4.38 per metric million british thermal unit in January to $8.14 per metric million british thermal unit in May on continued demand for LNG exports, higher gas-fired power demand and lower output compared with the end of 2021. But prices at the hub fell in June after the Freeport LNG terminal shut down. The prices have been volatile this year, driven by global gas market uncertainty from Russia’s invasion of Ukraine and weather-related demand fluctuations.

It is expected that U.S. refineries will run at an average capacity of 94 percent during the third quarter of 2022, a stronger capacity factor than last year. Meanwhile, U.S. refinery capacity has decreased since 2019. By the end of 2023, 24 gigawatts of coal-fired power plants will retire, which will cut coal consumption by 3 percent in 2022 and 4 percent in 2023. By 2023, renewable energy will generate 24 percent of U.S. electricity, up from 20 percent in 2021. By 2023, solar power will generate 71 percent more electricity than it did at the end of 2021, primarily due to its growth in capacity.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL