Venezuela’s Heavy Crude Oil Production Growth to be Limited Despite U.S. Sanctions Relief: EIA

Venezuela’s crude oil production growth is projected to be less than 200,000 barrels per day (b/d) by the end of 2024, despite the U.S temporarily lifting most of the sanctions on the country’s energy sector, according to an Oct. 23 report from the U.S. Energy Information Administration. Years of mismanagement and a lack of investment in Venezuela’s energy sector is projected to restrict crude oil production growth.

The U.S. Department of the Treasury of Foreign Assets Control on Oct. 18 issued four General Licences suspending select sanctions on the Venezuelan energy sector. As part of the sanctions relief, the department issued a six month general licence provisionally permitting transactions involving the oil and gas sector in Venezuela.

The U.S. sanctions relief would allow Venezuela to export additional volumes of the heavy, sour crude oil the country produces. However, export growth is expected to be low, despite the recent price rise for this crude type due to weak crude oil production in the country.

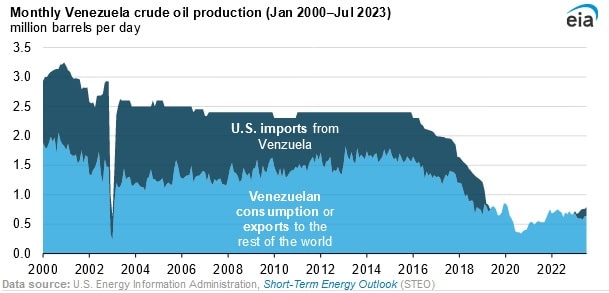

In terms of trading dynamics, Venezuela’s crude oil production has declined from 3.2 million b/d in the year 2000 to 735,000 b/d in September 2023. Similarly, U.S. crude oil imports declined from 1.3 million b/d in 2001 to around 510,000 b/d in 2018, thereafter oil imports ceased in 2019 and returned under limited sanctions relief in January 2023 and rose to 153,000 b/d in July 2023. U.S. crude oil imports creased after January 2019, when the U.S. implemented sanctions on state oil company Petróleos de Venezuela SA (PdVSA). The U.S. eased those sanctions in November 2022 when the department permitted waivers to Chevron, allowing it to continue crude oil exports from its joint venture operations in Venezuela to U.S. Gulf Coast refineries, which resumed in January 2023.

During September 2023, Venezuelan crude oil production declined from the recent high in July 2023 of 790,000 b/d. The production decline can be attributed to a shortage of diluent, which is essential to process the heavy oil. The relief of sanctions will permit for increased diluent imports, which could boost production.

Additional increases in Venezuelan crude oil production are expected to take time, as the country’s crude oil production capacity and infrastructure has experienced long periods of neglect due to lack of access to capital and regular upkeep. As it stands, the potential for further production growth is uncertain, since to increase production further the Venezuelan energy sector would require new investment in infrastructure and assets.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL