New York Leads the Nation in Exploring Wholesale Market Design for Distributed Energy Resources

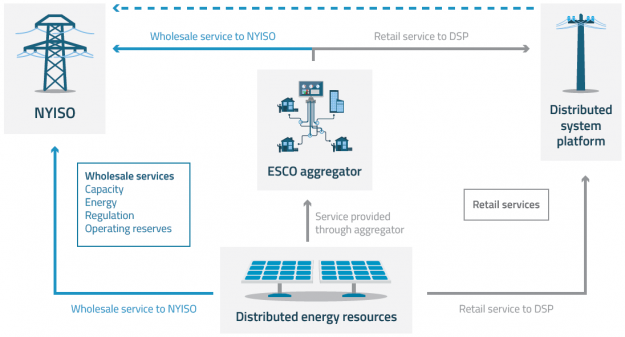

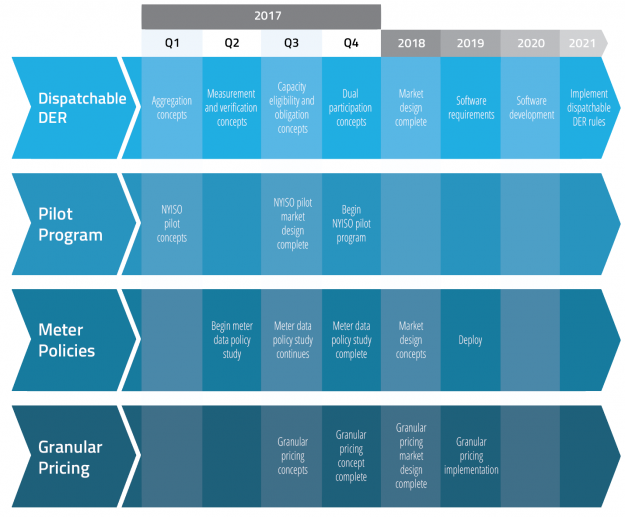

The New York Independent System Operator has launched a pilot program to examine how the integration of emerging distributed energy resource (DER) technologies will affect wholesale market systems. The pilot program aligns with the state’s objectives under the Reforming the Energy vision (REV) to expand retail markets for DER. Access to wholesale markets will be critical in integrating the growing share of DERs, and state and ISO-level policies will play a key role in this regard.