Visual Primer: U.S. Advances Initiatives to Increase Competitiveness of Nuclear Power

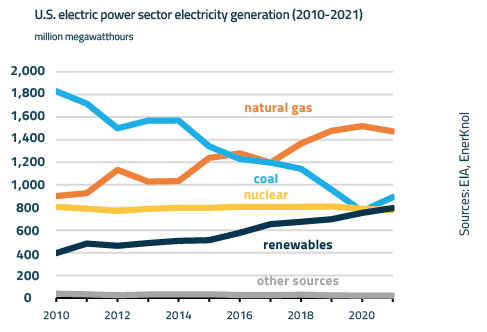

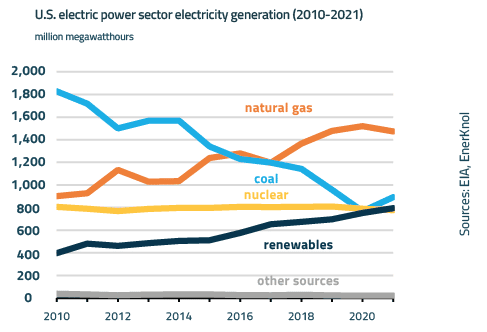

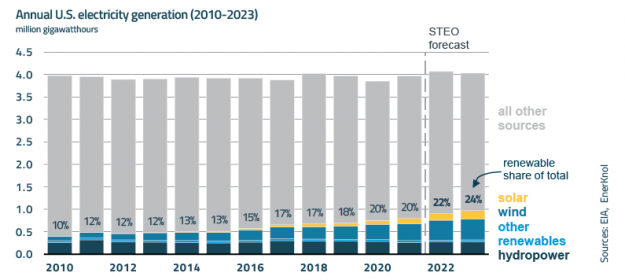

Efforts to preserve and expand the U.S. nuclear fleet are figuring more prominently across the U.S., spurred by the growing demand for emission-free energy. In particular, policy actions and initiatives are geared towards making nuclear power more competitive.