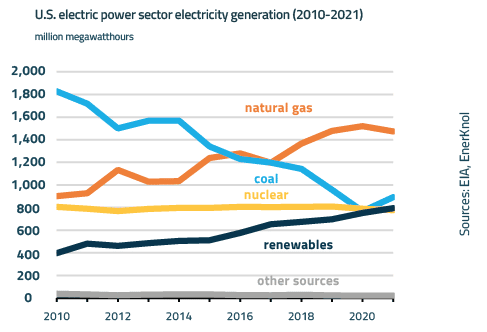

Visual Primer: Massive Subsidies Support Advanced Reactor Design While Protecting Traditional Nuclear Plants

Policy developments around nuclear energy continue to evolve driven by new reactor technologies and the need for carbon-free power to support clean energy goals. Nuclear operators can have their yellowcake and eat it too as massive federal and state subsidies protect traditional nuclear power plants while underwriting the development of advanced reactors.