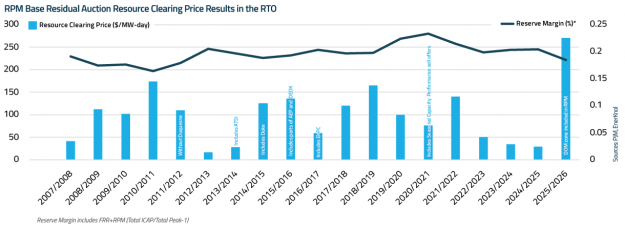

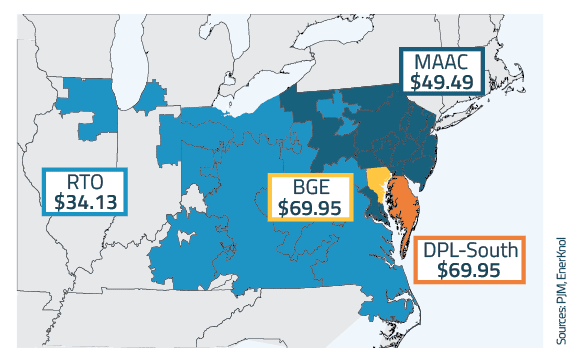

PJM Capacity Auction Prices Rise as Supply-Demand Balance Tightens

PJM Interconnection LLC’s capacity market auction for the 2026/2027 delivery year cleared at $329.17 per megawatt-day (MW-day), nearly 22 percent higher than the clearing price in the previous auction. The clearing price hit the cap recently approved by the Federal Energy Regulatory Commission (FERC) to…Read the full report…...