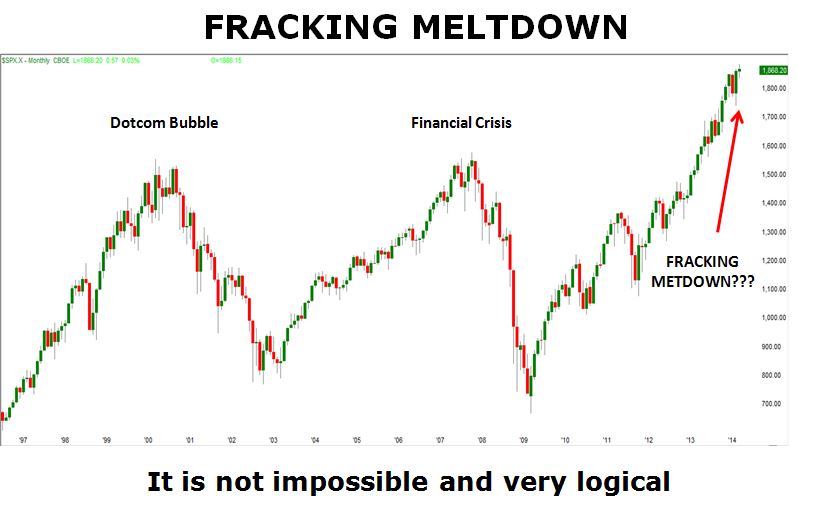

Is this the next major bump in the road or the “new normal”? In 2000, we had the culmination of the dotcom bubble. In 2008, we had the mortgage debacle or what some call the financial crisis. Now we are in what could inevitably be the 2015 fracking meltdown. Most would not refer to this as the fracking meltdown but let’s look at the reality of the situation. What has driven the oil boom? Fracking has, for the most part.

Is this the next major bump in the road or the “new normal”? In 2000, we had the culmination of the dotcom bubble. In 2008, we had the mortgage debacle or what some call the financial crisis. Now we are in what could inevitably be the 2015 fracking meltdown. Most would not refer to this as the fracking meltdown but let’s look at the reality of the situation. What has driven the oil boom? Fracking has, for the most part.

New technologies have led us to what some think is unlimited fossil fuels, therefore driving supply up and demand down. This has had an enormous effect on many areas of the economy. Here are some interesting facts: The average salary for jobs in the oil industry in North Dakota was more than $100,000 in 2013, double the state average. North Dakota has the lowest unemployment rate in the country. Why? Fracking. Gas is under $2.00 per gallon in many states. Why? Fracking. We will see a major amount of layoffs across the oil and gas sector. This all will lead back to innovation and our ability to pull oil from a rock. So yes, we will call it the “Fracking Meltdown”.

My extra $700/year from cheap gas

Consumers are grinning from ear to ear as gas prices continue to drop. Who would have thought that we would see gas at $2.00 per gallon in New York and under $2.00 in most of the nation? Answer: Nobody!!! What does this really translate to in the long run? Do these gas prices continue to help us prosper like the media leads us to believe, or are they the beginning of the end for this china-doll-at-best recovery in our economy? Low gas prices are great and make people happy. I can now save $700 due to the cheap gas prices according to a report on CNBC. Societe Generale is also stating that we are in great shape and the consumer does not even understand how good they have it.

I don’t find this to be the case at all as we see a domino effect beginning to form. Typically, the average consumer is in a bubble when it comes to macro views of the world. I mean, why would anyone want to follow or care about the things we can’t change? Today, as in 2006-07 we should start to take a hard look. Remember all the buy gold commercials advertising at $1,800 an ounce? Where were they at $800 an ounce? They didn’t exist because there was nothing to talk about, no hype or momentum. Many people bought into gold and were crushed. Oh sure, it could come back and maybe soon but they were still crushed and now have a dead investment. Now, let’s look back over the last 18 months and think of all the commercials on TV about oil. It’s the same thing, and now it is 50 percent off! Today, it looks like a bad movie about Wall Street, as many analysts are saying, “If you liked it at $100, you must love it at $45!” Today, you must take a macro look at many different things happening that need to be seen in order to make the right decision.

Be careful what you wish for

One of the pros of falling gas prices are the investment opportunities that become available for both institutions and retail investors. The question is when to actually pull the trigger. Stocks of private equity firms who have made oil and gas acquisitions have been crushed. Is it a good time to buy these? Well, any good trader is not afraid of buying when prices drop, but today we must look at a bigger picture. Bloomberg compiled data and showed that more than a dozen firms including Carlyle, Apollo, Warburg Pincus, and Blackstone have lost a combined $11.7 billion in publically traded oil producing companies since June. If they can hold on — which they inevitably will — these companies will profit while many are raising money to take advantage of some of these bargain basement opportunities. But can they really justify this? Take a look at the $7+ billion acquisition that KKR completed in 2011 of Samson Resources. The Wall Street Journal reported recently that the company has lost more than $3 billion on this deal alone.

One of the pros of falling gas prices are the investment opportunities that become available for both institutions and retail investors. The question is when to actually pull the trigger. Stocks of private equity firms who have made oil and gas acquisitions have been crushed. Is it a good time to buy these? Well, any good trader is not afraid of buying when prices drop, but today we must look at a bigger picture. Bloomberg compiled data and showed that more than a dozen firms including Carlyle, Apollo, Warburg Pincus, and Blackstone have lost a combined $11.7 billion in publically traded oil producing companies since June. If they can hold on — which they inevitably will — these companies will profit while many are raising money to take advantage of some of these bargain basement opportunities. But can they really justify this? Take a look at the $7+ billion acquisition that KKR completed in 2011 of Samson Resources. The Wall Street Journal reported recently that the company has lost more than $3 billion on this deal alone.

Before going for broke and putting it all on black you need to really understand some of the complexities of the business and the fact that they are all driven by debt.

Energy companies have gone on a borrowing spree over the last few years as they were trying to exploit the fracking boom. As in the housing boom, many low-rated companies were receiving financing and pushing leverage to all-time highs. The CreditSights forecast of an 8 percent default rate next year equates to about 14 companies going bankrupt. The question is, which ones?

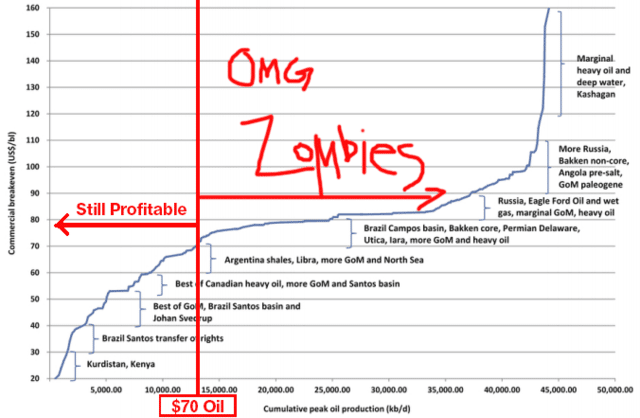

After crude prices dropped 49 percent in six months, oil projects planned for next year are the undead — still standing upright, but with little hope of a productive future. These zombie projects proliferate in expensive Arctic oil, deepwater-drilling regions and tar sands from Canada to Venezuela.

Goldman Sachs found almost $1 trillion in investments in future oil projects at risk. They looked at 400 of the world’s largest new oil and gas fields, excluding U.S. shale, and found projects representing $930 billion of future investment that are no longer profitable with Brent crude at $70. See the chart below. This shows the break-even points for the top 400 new fields. Less than a third of projects are still profitable with oil at $70.

If prices continue to fall, we could see a shift, not only in current production but future projects as well. Next year alone, oil and gas companies will make final investment decisions on 800 projects worth $500 billion, said Lars Eirik Nicolaisen, a partner at Oslo-based Rystad Energy. If the price of oil averages $70 in 2015, he wrote in an email, $150 billion will be pulled from oil and gas exploration around the world.

An oil price of $65 dollars per barrel next year would trigger the biggest drop in project finance in decades, according to a Sanford C. Bernstein analysis.

Oil’s crash will make millionaires and billionaires out of people as there will be many incredible opportunities to sift through as this shakes out. Sounds great, right? Not so fast.

What we typically don’t see are all of the effects on service-related companies, not to mention every company that is in close proximity to the oil industry. Let’s say the rig count continues to drop. The layoffs will be next. After the layoffs are the additional services like housing, food, entertainment and so on. In an area dominated by oil companies, many people will be hurt. They will be your average American trying to get by with a small business, trying to put food on the table. This is where the tragedies become real. The larger companies can usually hold their own, and with lots of help they stay afloat but all of the small to mid-size firms suffer. Many go out of business completely.

This doesn’t sound so far-fetched, as this has been the case in the past two market crashes, in 2000 and 2008 respectively. The only problem is that there are going to be more small businesses and people effected for sure. The oil industry itself has already seen this numerous times because there are many boom to bust stories. Today the fracking industry is not much different than the gold rush of the 1800’s.

Domino effect

There is a domino effect that is beginning to take place in the oil and gas sector and it could spill over to the everyday mom and pop shop. People that believe they are saving money on cheap gas need to be aware of what the long-term effects are. CNBC recently reported that the fall in oil will make people $700 richer this year. There are Wall Street firms jumping on this and I can’t find a reason why, except wanting people to invest and not save. Any true analyst can see that we are in a very rocky place. Look at the facts here. Low oil has done the following already:

- Shutting down rigs

This is already being seen. In the first couple weeks of January, we have already heard of more than 75 rigs shutting down. Each rig has 50+ people working on it. Now, since the beginning of the third quarter of 2014, there have been close to 200 rigs shut down.

- Layoffs

Based on what we already know, we should expect at least 12,000 layoffs just from the oil companies. Will this translate into another 10,000 from service companies in and around the oil sector? Maybe. So far, more than 10,000 people in the oil industry have already been laid off. Even if the number of people being laid off stays modest, it will spill over and create a domino effect to other industries for sure. There are plenty of examples from events already taking place. US Steel laid off more than 600 workers because there was not a need for tubing that is used in rigs. Companies that provide housing for oil workers like Civeo are cutting jobs.

There are close to 10 million people working in and around the oil industry. These are companies that are not working directly for the oil companies such as cement, finance, transportation, engineering, housing and so on. Each one of these jobs is very high paying.

It is not all bad. People will begin to spend money in other areas, and without a question, some industries will be impacted positively. Airlines such as American, Southwest and Continental will see the benefit of fuel savings..

We can also expect delivery companies such as FedEx and UPS to benefit. They will profit from the drop in gas prices, from both their air and land fleets.

Falling stock prices

The stock prices are just the tip of the iceberg because oil producers typically fund projects with enormous debt and bond prices are beginning to show the stress. Will these companies be able to pay their debt? Does it matter? Yes and no. The larger companies will simply roll their debt and restructure it, saving them for now. It is the smaller companies who do not and will not have access to the capital markets. They are the ones that will create this mounting avalanche of bankruptcies similar to 2008. This includes many small banks leading to many other companies in all sectors of the markets. With the prices of natural gas and oil off by more than 50 percent, production revenues have been dismal with many companies revising their forecasts and cutting them by 50 percent. One of the areas we are seeing the biggest impact is with companies that have not hedged their production using the futures markets to lock-in prices. Hedging is a major aspect of the oil and gas markets that allows companies to protect their interests during periods of decline. The problem with a plunge in the markets is that once these hedges expire, it will only get worse opening up another wave of bankruptcies.

The industry has been through this before. They must know what they are doing, don’t they? Well, the financial markets had trouble before, but that did not make it okay in 2008 when the crash took place. Some are saying everything is okay and that is simply insane. In macro view of OPEC holding firm, and Russia, Iran, Iraq, Nigeria and Venezuela failing to cut production, in some cases raising it, only makes this more a reality. Essentially, the world is being plunged into a recession by cheap oil. Go figure.

Low oil prices are here to stay

Brent crude oil slumped more than 50 percent and dropped below $50 per barrel from its high this year of $115 per barrel, and OPEC does not care about prices. They are trying to shake out the US Shale boom and, for lack of better words, put them out of business. Whether they say so or not, it appears to be the case. OPEC, specifically the Saudis, are more interested in holding on to market share. They are not worried if they can make their budget.

Henry Kravis, co-CEO of New York-based KKR, said that he welcomes the decline as a chance to fund cash-starved producers.

Carlyle co-CEO David Rubenstein said the next five to ten years stack up “as one of the greatest times” to invest in energy.

“If you have an asset you already own, it’s probably going to go down in value,” Rubenstein said. If you have a lot of untapped money to invest, “it’s a great time to buy,” he said, adding that Washington-based Carlyle has about $7 billion to spend in energy.

U.S. oil output is set to reach 9.42 million barrels per day in May. This would be the highest output going all the way back to 1972, according to the Energy Department’s statistical arm. What we cannot afford to do is capitulate and let OPEC or any other county dictate how much we pump. Therefore, we will need to continue to put money into new technologies while loosening regulation in order to bring costs down. In the meantime, oil and gas companies will be forced to trim their expenses and lay off staff while also shifting their focus to lower-cost fields. This means pumping more oil with fewer drilling rigs.

The next 12-18 months will truly dictate where the “new normal” for oil will end up. We need to remember that prices of more than $100 per barrel are not normal and have not been until very recently. We are actually getting back to what is more realistic.

Donovan Lazar | Chief Revenue Officer

dl@enerknol.com | 212-537-4797 ext. 8