Plausible Legislation Would Bolster Oil and Gas, Energy Efficiency Industries

The implementation of planned Republican legislation and Obama Administration regulations will have direct impact on utilities, regional regulators and conventional and renewable energy industries in the next year. Passage of the Keystone XL bill would ease crude oil transportation constraints to the lower 48 and support various pipeline-crossing state and local economies. The bipartisan-supported LNG infrastructure bill would support both producers and terminal owners through timely access to global markets, while a comprehensive energy efficiency bill would directly impact utilities and bolster energy efficiency companies.

If Approved, Keystone XL Would Ease Canadian Crude Transport Constraints

The Keystone XL pipeline would link with existing pipelines to bring significant crude oil supplies to southern Texas refineries, providing additional state tax revenues. Overall, the states with most to gain from the project are those through which the pipeline and associated southern pipelines would cross: Montana, North Dakota, South Dakota, Nebraska, Kansas, Oklahoma, and Texas; as well as those in which steel and other construction supplies are produced. Under the proposed legislation, the State Department’s Final Supplemental Environmental Impact Statement (SEIS), which was issued in January 2014, would fully satisfy the NEPA requirements and other statutory provisions that require federal agency consultation or review. Reducing dependence on foreign oil and creating thousands of domestic jobs are consistent pro-Keystone XL talking points. If approved, the proposed 875- mile Keystone XL pipeline would deliver up to 830,000 barrels per day (bpd) of oil sands extracted in Alberta (Canada) and crude oil from the Bakken shale formation in North Dakota and Montana to Steele City, Nebraska and subsequent delivery to Gulf Coast refineries.

The Keystone XL pipeline would link with existing pipelines to bring significant crude oil supplies to southern Texas refineries, providing additional state tax revenues. Overall, the states with most to gain from the project are those through which the pipeline and associated southern pipelines would cross: Montana, North Dakota, South Dakota, Nebraska, Kansas, Oklahoma, and Texas; as well as those in which steel and other construction supplies are produced. Under the proposed legislation, the State Department’s Final Supplemental Environmental Impact Statement (SEIS), which was issued in January 2014, would fully satisfy the NEPA requirements and other statutory provisions that require federal agency consultation or review. Reducing dependence on foreign oil and creating thousands of domestic jobs are consistent pro-Keystone XL talking points. If approved, the proposed 875- mile Keystone XL pipeline would deliver up to 830,000 barrels per day (bpd) of oil sands extracted in Alberta (Canada) and crude oil from the Bakken shale formation in North Dakota and Montana to Steele City, Nebraska and subsequent delivery to Gulf Coast refineries.

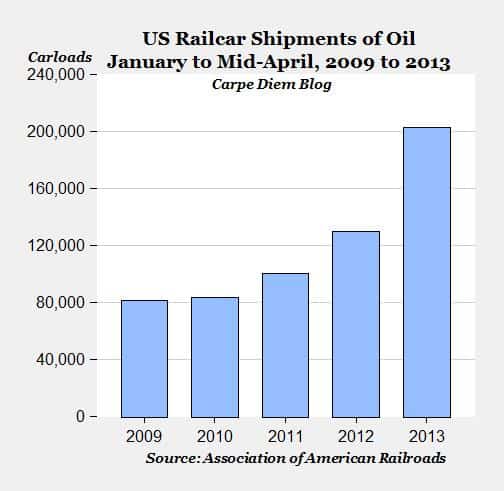

Crude oil prices remain the key driver to Canadian oil sands production. The recent decline in domestic and global oil prices, if sustained, could impact Canadian oil sands production, as prices below $65-75 per barrel challenge breakeven supply costs of smaller operations. Larger producers, such as Suncor Energy, Syncrude Canada and Cenovus Energy have breakeven levels closer to the $30-40 range and are better positioned to tolerate the currently low crude oil price environment. Keystone XL approval would ease crude oil transportation constraints, because much of the Canadian supply is moved by rail and more than three million bpd of existing pipeline capacity. The pipeline would supply refiners such as Valero Refining Co, CITCO Petroleum Corp and Houston Refining LP. This supply could ease reliance on imports from Venezuela, Mexico and other South American countries. Still, despite the potential domestic heavy crude supply increase with an approved pipeline, the project would have minimal impacts on benchmark (West Texas Intermediate [WTI]) prices. This price is tied more to total domestic and global supply-demand factors, not to Canadian crude oil import capacity.

Donovan Lazar | Chief Revenue Officer

dl@enerknol.com | 212-537-4797 ext. 8