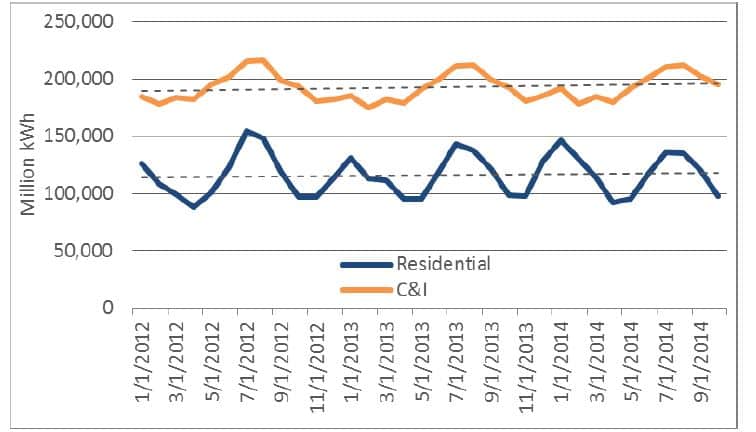

The prospect of dramatically higher energy efficiency would impact many facets of the energy industry, but particularly utilities that service regions with federal customers and energy efficiency companies that would address new building codes and other requirements. The recently introduced amendment to the Keystone bill, the Energy Efficiency Improvement Act of 2015, was a pared down version of the Energy Savings and Industrial Competitiveness Act (Shaheen-Portman bill) from the prior Congress. The Shaheen-Portman bill contained provisions with major impacts on buildings, manufacturers and the federal government, with a particular emphasis on the commercial and industrial (C&I) sector. Since C&I facilities are generally larger than residential houses and thus consume significantly more electricity, the incorporation of energy efficient measures at a single C&I location can result in substantial kilowatt-hour (kWh) savings. Passage of a federal energy efficiency bill could reverse the slightly upward C&I electricity usage trend that has occurred over the previous three years.

The prospect of dramatically higher energy efficiency would impact many facets of the energy industry, but particularly utilities that service regions with federal customers and energy efficiency companies that would address new building codes and other requirements. The recently introduced amendment to the Keystone bill, the Energy Efficiency Improvement Act of 2015, was a pared down version of the Energy Savings and Industrial Competitiveness Act (Shaheen-Portman bill) from the prior Congress. The Shaheen-Portman bill contained provisions with major impacts on buildings, manufacturers and the federal government, with a particular emphasis on the commercial and industrial (C&I) sector. Since C&I facilities are generally larger than residential houses and thus consume significantly more electricity, the incorporation of energy efficient measures at a single C&I location can result in substantial kilowatt-hour (kWh) savings. Passage of a federal energy efficiency bill could reverse the slightly upward C&I electricity usage trend that has occurred over the previous three years.

The emphasis on electricity reduction would have economic implications for both utilities and the energy efficiency industry. Utilities with large concentrations of federal facilities in their service territory could be at risk of losing substantial sales if a comprehensive energy efficiency bill becomes law. For example, companies such as PEPCO, which serves Washington D.C. and SDG&E, with a large concentration of navy bases in San Diego, could be at risk of diminishing sales from their federal customers.

The emphasis on electricity reduction would have economic implications for both utilities and the energy efficiency industry. Utilities with large concentrations of federal facilities in their service territory could be at risk of losing substantial sales if a comprehensive energy efficiency bill becomes law. For example, companies such as PEPCO, which serves Washington D.C. and SDG&E, with a large concentration of navy bases in San Diego, could be at risk of diminishing sales from their federal customers.

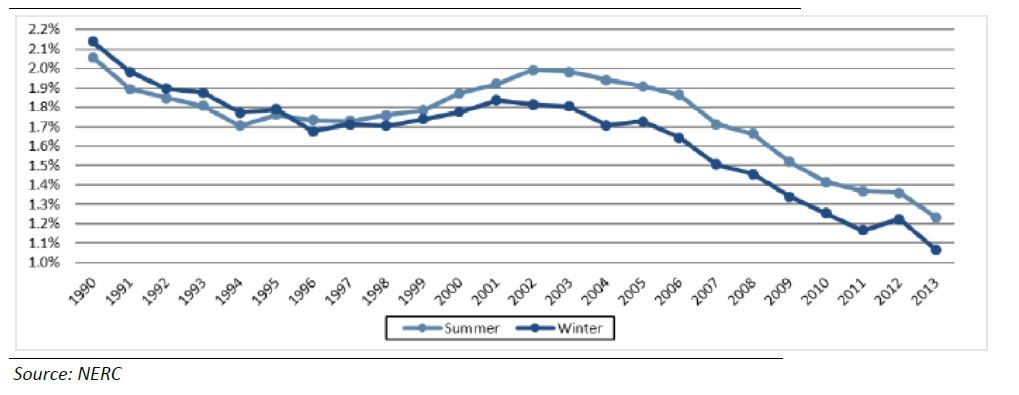

Another potential impact from an energy efficiency bill is in how new building codes and the adoption of new technologies would affect peak energy usage. There are seasonal electricity usage patterns, with demand typically peaking in the summer when air conditioners are running. Since transmission infrastructure and generating resources are built to handle peak demand, new infrastructure often has to be built to handle a small amount of new incremental load. New building codes are effective in lowering peak demand by requiring efficient lighting, insulation and HVAC equipment. This is different from distributed generation resources, which usually don’t reduce actual usage, but rather reduce the need for certain types of generating sources or simply shift peak system demand back further in the day. An energy efficiency bill with far-reaching implications for both the residential and commercial sector would likely affect peak load and contribute to the declining peak demand growth trend.

The end result of declining peak demand growth would be less build-out of transmission infrastructure and generation of sources to handle peak load. This, in turn, would mean fewer assets in a utilities’ rate base that they can earn a return from. This may force utilities and merchant power generators to look for expansion opportunities in areas where peak demand may still be increasing or for other revenue opportunities outside of transmission and generation.

The end result of declining peak demand growth would be less build-out of transmission infrastructure and generation of sources to handle peak load. This, in turn, would mean fewer assets in a utilities’ rate base that they can earn a return from. This may force utilities and merchant power generators to look for expansion opportunities in areas where peak demand may still be increasing or for other revenue opportunities outside of transmission and generation.

On the other side, adding additional energy efficiency requirements to new buildings would expand energy efficiency industries and ancillary sectors associated with those industries. Energy efficiency spending has grown rapidly over the last decade, with more than $7 billion spent on energy efficiency in 2012 alone.

Energy efficiency is both a “push” and “pull” industry. Some portion of the industry is driven by customers wanting to lower their bills and be more comfortable in their homes and businesses. A large portion of the industry is driven purely by the necessity to comply with regulations. In its 2014 Clean Energy Industry Report, the Massachusetts Clean Energy Council (MassCEC) asked in-state energy efficiency firms about policies and programs that could potentially have the largest impact on their business (Figure 6). The third most common answer was “Regulations on Building or Energy Codes.” By strengthening building codes and providing training for commercial building design, the passage of provisions like those in the Shaheen-Portman proposal would have significant impacts on energy efficiency businesses by increasing the demand for their products and services. On the other side, firms were also asked about the biggest impediments to success, and regulations were once again a frequently cited source.

Donovan Lazar | Chief Revenue Officer

dl@enerknol.com | 212-537-4797 ext. 8